|

|

|

|

|

Ofcourse, registration is Free!

|

|

|

|

|

|

|

Greetings!

GSTN Advisory on Facility for Withdrawal from Rule 14A, Dated 21st

February 2026

GSTN has enabled online filing of Form GST REG-32 on the GST Portal for withdrawal from Rule 14A option.

Active taxpayers registered under Rule 14A can apply for opting out in accordance with the provisions of the law.

After Login → Services → Registration → Application for Withdrawal from Rule 14A. “Option for registration under Rule 14A” auto-selected as No.

Mention reason for withdrawal. Complete Aadhaar authentication (Primary Authorised Signatory + one Promoter/Partner)

Return Filing Conditions:

If filed before 01.04.2026 → Minimum 3 months’ returns to be filed

If filed on/after 01.04.2026 → Minimum 1 tax period return to be filed

All returns from registration date till application date must be filed

The Primary Authorised Signatory must complete it, and at least one Promoter/Partner (if applicable) must also authenticate. Only after successful Aadhaar authentication will the Application Reference Number (ARN) be generated.

Draft application to be submitted within 15 days. Aadhaar/Biometric authentication must be completed within 15 days from submission. If authentication is not completed within the prescribed time, ARN will not be generated.

Core amendment, non-core amendment, and self-cancellation applications cannot be filed while REG-32 is pending

Click to view / Download

Date : 21/02/2026

GSTN Advisory on Advisory on Interest Collection and Related Enhancements in GSTR-3B, Dated 19th

February 2026

In continuation of the advisory dated 30th January 2026 issued on the GST Portal, an important update has been provided regarding ITC utilisation.

From the February 2026 tax period onwards, taxpayers can utilise CGST or SGST Input Tax Credit (ITC) for payment of IGST liability, in any order, after fully exhausting IGST credit

Click to view / Download

Date : 19/02/2026

Finance Bill 2026, Dated 1st

February 2026

The Finance Bill 2026 was introduced in the Lok Sabha on 1 February 2026 to implement the government’s financial proposals for the 2026–27 fiscal year.

It outlines changes to direct and indirect tax laws, including income-tax rates, surcharge and cess provisions, and amendments affecting GST, customs, securities transaction tax and compliance rules.

Click to view / Download

Date : 02/02/2026

GSTN Advisory on Interest Collection and Related Enhancements in GSTR-3B, Dated 30th

January 2026

Few enhancements have been made in filing of GSTR-3B

Interest will now be calculated after giving benefit of the minimum cash balance available in Electronic Cash Ledger from due date till tax payment, as per Rule 88B(1).

Interest will be auto-populated and non-editable

GST Portal will auto-populate tax liability pertaining to previous periods but paid in current period, based on document dates in GSTR-1 / GSTR-1A / IFF.

After full utilization of IGST ITC, remaining IGST liability can be paid using CGST and SGST ITC in any order

For cancelled registrations, interest on delayed filing of the last GSTR-3B will be levied and collected via GSTR-10 (Final Return).

The detailed advisory through the link provided below.

Click to view - GSTN Advisory on Interest Collection and Related Enhancements in GSTR-3B

Click to view / Download

Date : 31/01/2026

GSTN Advisory on RSP-Based Valuation of Notified Tobacco Goods under GST, Dated 23rd

January 2026

The advisory clarifies the correct method of reporting taxable value and tax liability for RSP-based valuation goods in e-Invoice, e-Way Bill and GSTR-1 / GSTR-1A / IFF

Taxpayers dealing in notified tobacco products must carefully follow the prescribed reporting mechanism to avoid validation errors and ensure accurate GST discharge.

The detailed advisory through the link provided below.

Click to view -Advisory on RSP-Based Valuation of Notified Tobacco Goods under GST

Click to view / Download

Date : 24/01/2026

GSTN Advisory on Filing Opt-In Declaration for Specified Premises, 2025, Dated 4th

January 2026

As per Notification No. 05/2025 – Central Tax (Rate) dated 16.01.2025, declarations for declaring hotel accommodation premises as “Specified Premises” are now enabled electronically on the GST Portal.

Applicants for new GST registration intending to declare premises as specified premises. Not applicable to composition taxpayers, TDS/TCS, SEZ units/developers, casual taxpayers, or cancelled registrations.

Annexure VII: File between 1st Jan – 31st Mar of the preceding financial year.

Annexure VIII: File within 15 days of ARN generation for new registrations.

Suspended taxpayers can file; cancelled taxpayers cannot file

For FY 2025–26, declarations were manual; for FY 2026–27, they must be filed electronically between 1st Jan – 31st Mar 2026.

Click to view / Download

Date : 06/01/2026

CGST Notification , Dated 31st

December 2025

|

Notification No. |

Date |

Subject |

|

19/2025-Central Tax |

31/12/2025 |

Amends Notification No. 49/2023–Central Tax, dated 29-09-2023, a new clause (iv) is inserted prescribing valuation based on Retail Sale Price (RSP) for specified goods, like tobacco, pan masala, and nicotine products. This notification shall come into force on the 1st day of February 2026.

|

|

20/2025-Central Tax |

31/12/2025 |

Introduces Central Goods and Services Tax (Fifth Amendment) Rules, 2025 Effective from 1st February 2026. A new Rule 31D is inserted to prescribe RSP-based valuation for specified goods and Rule 86B Proviso clause (f) inserted.

|

Click to view / Download

Date : 02/01/2026

CGST Notification 19/2025 Central Tax (Rate), Dated 31st

December 2025

This notification restructures GST rates on tobacco and related products, mainly to- Increase tax burden on tobacco and nicotine products and Remove the 14% slab entirely. From 1 February 2026, most tobacco products will attract 20% GST, while biris will be taxed at 9%.

Click to view / Download

Date : 02/01/2026

IGST Notification 19/2025 Integrated Tax (Rate), Dated 31st

December 2025

Amends Notification No. 9/2025 – Integrated Tax (Rate) dated 17-09-2025, Effective from 1st February 2026. It clarifies most tobacco products will attract 40% IGST, while biris will be taxed at 18%

Click to view / Download

Date : 02/01/2026

GSTN Advisory & FAQ on Electronic Credit Reversal and Re-claimed Statement & RCM Liability/ITC Statement, Dated 29th

December 2025

Introduced on the GST portal from August 2023 (monthly returns) and July–September 2023 (quarterly returns), the Reclaim Ledger ensures accurate tracking of Input Tax Credit (ITC).

It records ITC that is temporarily reversed in Table 4(B)(2) and its subsequent reclaim in Table 4(A)(5) and 4(D)(1), thereby reducing clerical errors and improving compliance transparency.

Taxpayers receive a warning message if they attempt to re-claim more ITC in Table 4D(1) than the available reversal balance, though filing of Form GSTR-3B is still permitted.

This statement can be viewed by the taxpayer by navigating to the Dashboard › Services › Ledger › Electronic Credit Reversal and Re-claimed.

Introduced on the GST portal from August 2024 (monthly returns) and July–September 2024 (quarterly returns), the RCM Ledger helps taxpayers accurately report Reverse Charge Mechanism (RCM) transactions.

Taxpayers receive a warning message if ITC claimed in Table 4(A)(2) and 4(A)(3) exceeds the closing balance of the RCM Ledger plus liabilities in Table 3.1(d).

The RCM Liability/ITC Statement is accessible via Services >> Ledger >> RCM Liability/ITC Statement.

Taxpayers will not be allowed to report negative values or excess ITC beyond available balances

The GST system now enforces strict compliance by blocking GSTR-3B filing if taxpayers have a negative closing balance in either the Reclaim Ledger or the RCM Ledger.

FAQs related to Electronic Credit Reversal and Re-claimed Statement and RCM Liability/ITC Statement attached this pdf

Click to view / Download

Date : 29/12/2025

GSTAT Revokes Staggered Filing of Appeals Order (Order No. 315/2025), Dated 16th

December 2025

GSTAT has by Order No 315/2025 dated 16th December 2025 revoked with effect from 18/12/2025 the earlier order No 125/2025-26/1499-1502 dated 24.09.2025 on staggered filing of appeals.

Click to view / Download

Date : 16/12/2025

GSTN Advisory for Auto Suspension of GST Registration due to Non-Furnishing of Bank Account Details as per Rule 10A

|

Taxpayers (except TCS, TDS, and Suo-moto registrations) must furnish bank account details:

Taxpayers (except TCS, TDS, and Suo-moto registrations) must furnish bank account details:

Within 30 days of registration, or Before filing GSTR-1/IFF, whichever is earlier.

If bank account details are not furnished within 30 days, the GST registration gets automatically suspended.

If bank account details are not furnished within 30 days, the GST registration gets automatically suspended.

Suspension order can be viewed at: Services → User Services → View Notices and Orders.

Suspension order can be viewed at: Services → User Services → View Notices and Orders.

Bank details can be added through a non-core amendment:

Services → Registration → Amendment of Registration (Non-Core Fields).

Bank details can be added through a non-core amendment:

Services → Registration → Amendment of Registration (Non-Core Fields).

After furnishing bank account details, cancellation proceedings are automatically dropped by the system.

After furnishing bank account details, cancellation proceedings are automatically dropped by the system.

|

.PNG)

|

If not dropped automatically on the same day, taxpayers can manually initiate the drop by using:

Services → User Services → View Notices and Orders → Initiate Drop Proceedings

OIDAR and NRTP taxpayers are exempt from furnishing bank details.

Exception: For OIDAR taxpayers who select

“Representative Appointed in India – Yes”, furnishing bank account details is mandatory.

Click to view /download

Date : 06/12/2025

GSTN Advisory on reporting values in Table 3.2 of GSTR-3B

Table 3.2 of GSTR-3B shows inter-State supplies made to unregistered persons, composition taxpayers, and UIN holders. These values are auto-populated from GSTR-1, GSTR-1A, and IFF.

From the November 2025 tax period, the values auto-populated in Table 3.2 will become non-editable.

If wrong data appears in Table 3.2, corrections must be made through Form GSTR-1A for the same tax period.

Taxpayers should ensure correct reporting in GSTR-1, GSTR-1A, or IFF.

Questions and answers related to this are given in Advisory PDF.

Click to view / Download

Date : 06/12/2025

GSTN Advisory for Simplified GST Registration Scheme

|

The Simplified GST Registration Scheme under Rule 14A offers a streamlined process for small taxpayers with a monthly output tax liability of 2.5 lakh or less.

The Simplified GST Registration Scheme under Rule 14A offers a streamlined process for small taxpayers with a monthly output tax liability of 2.5 lakh or less.

While applying in FORM GST REG-01, select “Yes” under Option for Registration under Rule 14A.

While applying in FORM GST REG-01, select “Yes” under Option for Registration under Rule 14A.

Aadhaar authentication is mandatory for the Primary Authorized Signatory and at least one Promoter/Partner.

Aadhaar authentication is mandatory for the Primary Authorized Signatory and at least one Promoter/Partner.

Registration granted within 3 working days post successful Aadhaar authentication.

Registration granted within 3 working days post successful Aadhaar authentication.

Minimum return filing requirement before withdrawal:

Minimum return filing requirement before withdrawal:

a) 3 months of returns if withdrawing before 1 April 2026.

b) 1 tax period return if withdrawing on or after 1 April 2026.

c) 3 months of returns if withdrawing before 1 April 2026.

|

|

Click to view /download

Date : 01/11/2025

18/2025 – CENTRAL TAX - Dated 31st October 2025 - GST (Fourth Amendment) Rules, 2025: Aadhaar-Based Optional Registration Scheme & New Compliance Forms

Central Goods and Services Tax (Fourth Amendment) Rules, 2025 effective from 1st November 2025

A new Rule 9A and Rule 14A is inserted.

Introduces an optional registration scheme for taxpayers having monthly output tax liability up to 2.5 lakh, allowing faster, Aadhaar-based registration and simplified compliance.

Updates to Rules 10 and 14, and related GST registration forms (REG-01, REG-02, REG-03, etc.) to these new provisions.

New Forms GST REG-32, GST REG-33 Introduced

Click to view / Download

Date : 31/10/2025

GSTN Advisory for Introduction of Import of Goods details in IMS

The Invoice Management System (IMS) was introduced on the GST portal starting from the October 2024 tax period

Enables users to accept, reject, or keep pending supplier-uploaded records via GSTR-1/1A/IFF.

A new “Import of Goods” section has been added to the IMS, which will be effective from the October 2025 tax period.

If no action is taken by the taxpayer on a BoE, it will be considered as “deemed accepted.”

Based on the actions taken in the IMS, the draft GSTR-2B (auto-drafted ITC statement) for the recipient will be generated on the 14th of the subsequent month.

Click to view / Download

Date : 29/10/2025

GSTN Advisory to file pending returns before expiry of three years

As per the Finance Act, 2023 (8 of 2023), effective from 1st October 2023 through Notification No. 28/2023 – Central Tax dated 31st

July 2023, a new restriction has been introduced under Sections 37, 39, 44, and 52 of the CGST Act.

According to this amendment, taxpayers will not be allowed to file GST returns after the expiry of three years from the due date of furnishing such returns.

This applies to various return forms including GSTR-1, 1A, 3B, 4, 5, 5A, 6, 7, 8, 9, and 9C.

The GSTN will implement this restriction on the GST portal from the November 2025 tax period.

Accordingly, any return whose due date has crossed three years as of that period will be barred from filing.

Click to view / Download

Date : 29/10/2025

CGST Circular 254/11/2025-GST, Dated 27th October 2025-

CBIC Clarifies Officer Jurisdiction and Monetary Limits Under Key GST Provisions

The CBIC issued this circular to clearly define and assign “proper officers” and their monetary limits for actions under key GST provisions — especially the Section 74A (tax determination), Section 75(2),Section 122 (penalties), and Rule 142(1A).

Click to view / Download

Date : 27/10/2025

CGST Notification 18/2025 Central Tax (Rate), Dated 24th October 2025-

Amendment to Definition of “Nominated Agency”

Notification No. 18/2025 – Central Tax (Rate) dated 24th October 2025 amends Notification No. 26/2018 – Central Tax (Rate). The amendment updates the definition of “Nominated Agency” in the Explanation section. The amendment comes into effect from 1st November 2025.

Click to view / Download

Date : 24/10/2025

CGST Notification 17/2025 Central Tax, Dated 18th October 2025

The Commissioner, on the Council’s recommendation, extended the filing deadline for FORM GSTR-3B. For monthly taxpayers (September 2025) - Due date extended to 25th October 2025. For quarterly taxpayers (July–September 2025) - Due date also extended to 25th October 2025.

Click to view / Download

Date : 18/10/2025

GSTN Advisory for GSTR 9/9C for FY 2024-25

The GST portal has enabled filing of GSTR-9 and GSTR-9C for FY 2024-25 from 12th October 2025. Taxpayers must ensure that all GSTR-1 and GSTR-3B returns for the year are filed to access these annual return forms. Detailed FAQs will be released soon to assist taxpayers with the filing process.

Click to view / Download

Date : 15/10/2025

Important Advisory on IMS, Dated 8th October 2025

Input Tax Credit (ITC) will continue to auto-populate from GSTR-2B to GSTR-3B. Invoice Management System (IMS) implementation does not change the auto-population mechanism.

GSTR-2B will be generated automatically on the 14th of every month. No taxpayer action needed for generation.

Taxpayers can still take actions in IMS after GSTR-2B generation and regenerate it before filing GSTR-3B.

Recipients can keep Credit Notes pending for a specified time.

Upon acceptance, they can manually adjust ITC reversal based on the extent of availed

Click to view / Download

Date : 08/10/2025

Instruction No 06/2025-GST, Dated 3rd October 2025

90% of refund claims for zero-rated supplies to be sanctioned provisionally based on system-generated risk evaluation.

Proper officer may deny provisional refund on a case-by-case basis with written reasons and proceed with detailed scrutiny.

Certain registered persons notified under Section 54(6) are ineligible for provisional refunds on zero-rated supplies.

Refunds categorized as “low-risk” by the system will receive 90% provisional refund post FORM GST RFD-02.

Proviso to Rule 91(2) to be used sparingly; routine scrutiny should not block provisional refunds

If excess refund is provisionally sanctioned, FORM GST RFD-08 must be issued for recovery.

90% provisional refund allowed for IDS claims filed on or after 01.10.2025.

Click to view / Download

Date : 04/10/2025

GSTAT Launched: Unified National Forum for GST Dispute Resolution Unveiled in New Delhi

|

Union Finance Minister Smt. Nirmala Sitharaman formally inaugurated the Goods and Services Tax Appellate Tribunal (GSTAT) in New Delhi, describing it as a transformative step from “One Nation, One Tax, One Market” to “One Nation, One Forum for Fairness and Certainty.”

Union Finance Minister Smt. Nirmala Sitharaman formally inaugurated the Goods and Services Tax Appellate Tribunal (GSTAT) in New Delhi, describing it as a transformative step from “One Nation, One Tax, One Market” to “One Nation, One Forum for Fairness and Certainty.”

Emphasis on jargon-free decisions, digital filings, virtual hearings, and time-bound processes.

Emphasis on jargon-free decisions, digital filings, virtual hearings, and time-bound processes.

Aims to reduce litigation delays, improve cash flows, and boost confidence among MSMEs and exporters.

Aims to reduce litigation delays, improve cash flows, and boost confidence among MSMEs and exporters.

GSTAT offers a nationwide, independent platform for second-level GST appeals, ensuring consistency, transparency, and timely justice.

GSTAT offers a nationwide, independent platform for second-level GST appeals, ensuring consistency, transparency, and timely justice.

The newly launched GSTAT e-Courts Portal enables online appeal filing, case tracking, and virtual hearings. Staggered filing is allowed until 30 June 2026 to ease transition.

The newly launched GSTAT e-Courts Portal enables online appeal filing, case tracking, and virtual hearings. Staggered filing is allowed until 30 June 2026 to ease transition.

|

|

Click to view /download

Date : 04/10/2025

CGST Circular 253/10/2025 – GST, Dated 1st October 2025

The CBIC has withdrawn Circular No. 212/6/2024-GST dated 26th June 2024, which prescribed procedures for providing evidence of compliance under Section 15(3)(b)(ii) of the CGST Act. Consequently, taxpayers are no longer required to follow the earlier procedure.

Click to view / Download

Date : 01/10/2025

CESTAT E-Filing Mandate Effective from November 15, 2025, Dated 1st October 2025

Appeals/applications must be filed online in PDF format via https://efiling.cestat.gov.in, signed by the appellant.

Memorandum of appeal/application must be in prescribed form, in PDF format, and signed by the appellant.

Each appellant must register on the portal; a dashboard will show appeal details and status.

All previously filed appeals (by assessee or representatives) must be uploaded to the portal under the “Document filing” submenu.

Users must register using their existing email ID. If not previously provided, they must contact the registry to update their details.

Users must select each appeal and upload all related documents (at least one week prior). Only uploaded documents will be considered during hearings.

Appeals are considered filed on the date the diary number is generated.

E-filing becomes mandatory from November 15, 2025. Physical filing ends on December 31, 2025

Click to view / Download

Date : 01/10/2025

GSTN Advisory for Invoice-wise Reporting Functionality in Form GSTR-7 on portal

|

Vide Notification No. 09/2025 – Central Tax dated 11.02.2025, Form GSTR-7 has been amended requiring invoice-wise reporting of tax deducted at source (TDS).

Vide Notification No. 09/2025 – Central Tax dated 11.02.2025, Form GSTR-7 has been amended requiring invoice-wise reporting of tax deducted at source (TDS).

This feature is now enabled on the GSTN portal and TDS deductors must report invoice-level details while filing GSTR-7 from September 2025 onwards, with the first due date being 10th October 2025

This feature is now enabled on the GSTN portal and TDS deductors must report invoice-level details while filing GSTR-7 from September 2025 onwards, with the first due date being 10th October 2025

Any issues can be raised via the Self-Service Portal on GSTN, with necessary details for resolution.

Any issues can be raised via the Self-Service Portal on GSTN, with necessary details for resolution.

|

|

Click to view /download

Date : 26/09/2025

GSTN Advisory to file pending returns before expiry of three years

As per Finance Act, 2023 (effective 01.10.2023 ), filing of certain GST returns will be barred after 3 years from the due date.

Applicable to returns under Section 37 – GSTR-1 / GSTR-1A , Section 39 – GSTR-3B, GSTR-4, GSTR-5, GSTR-5A, GSTR-6 , Section 44 – GSTR-9 / GSTR-9C , Section 52 – GSTR-7 & GSTR-8

Any return whose due date is 3 years old or more (as on Oct 2025) cannot be filed thereafter 1st November 2025.

Return Type-wise Details with Barred Period:

|

GST Forms |

Return Content |

Relevant Section |

Relevant Rule |

Barred Period (w.e.f. 01.11.2025) |

|

GSTR-1 / IFF |

Outward supplies (monthly/quarterly) |

Sec. 37

|

Rule 59 |

September 2022 / July–Sep 2022 |

|

GSTR-1A |

Amendment to outward supplies |

Sec. 37

|

Rule 59 |

September 2022 / July–Sep 2022 |

|

GSTR-3B / 3BQ |

Summary return with tax payment (monthly/quarterly) |

Sec. 39

|

Rule 61 |

September 2022 / July–Sep 2022 |

|

GSTR-4 |

Return for composition taxpayers |

Sec. 39

|

Rule 62 |

FY 2021–22 |

|

GSTR-5 |

Return for non-resident taxable person |

Sec. 39

|

Rule 63 |

September 2022 |

|

GSTR-5A |

OIDAR service providers return |

Sec. 39

|

Rule 64 |

September 2022 |

|

GSTR-6 |

Input Service Distributor return |

Sec. 39

|

Rule 65 |

September 2022 |

|

GSTR-7 |

TDS return under GST |

Sec. 39

|

Rule 66 |

September 2022 |

|

GSTR-8 |

TCS return by e-commerce operators |

Sec. 52

|

Rule 67 |

September 2022 |

|

GSTR-9 / 9C |

Annual Return & Reconciliation Statement |

Sec. 44

|

Rule 80 |

FY 2020–21 |

Unfiled returns will lapse permanently after 3 years

Taxpayers must reconcile and file pending returns before the cut-off to avoid blockage.

Click to view / Download

Date : 25/09/2025

CGST Circular, Dated 23rd September 2025

The CBIC has clarified that for communications sent through its eOffice application, the system-generated “Issue number”

(which can now be verified online at [verifydocument.cbic.gov.in](https://verifydocument.cbic.gov.in)) will itself be treated as the Document Identification Number (DIN). Hence, quoting a separate DIN is no longer required for such eOffice communications. However, DIN will continue to be mandatory for all other communications not sent through eOffice public option or not bearing a verifiable Reference Number (RFN) from the GST portal.

Click to view / Download

Date : 23/09/2025

GSTN Advisory for New Changes in Invoice Management System (IMS)

1. Pending Action for Records

Taxpayers can now keep certain records pending for one tax period only (monthly or quarterly, as applicable).

Records eligible for pending status:

Credit Notes (CN) / upward amendment of CN

Downward amendment of CN (where original CN rejected)

Downward amendment of Invoice / Debit Note (DN) (if original accepted & 3B filed)

ECO-document downward amendment (if original accepted & 3B filed)

2. Declaring ITC Reduction Amount

The IMS provides a facility for taxpayers to declare and reverse ITC only to the extent actually availed. No reversal is needed if ITC was not claimed, and partial reversal applies only for the portion availed. The system allows full or partial reversal, including past cases, for the specified records.

3. Option to Save Remarks

Taxpayers can add optional remarks while rejecting/keeping records pending.

Remarks will be visible in GSTR-2B and supplier’s outward supplies dashboard.

4. Important Dates

Effective from October tax period

Due date for keeping records pending is based on supplier’s communication date/tax period.

5. Prospective Application

Applicable only for records filed by suppliers after rollout.

Taxpayers should review carefully before filing returns

Click to view / Download

Date : 23/09/2025

CGST Notification , Dated 17th September 2025

|

Notification No. |

Date |

Subject |

|

13/2025-Central Tax |

17/09/2025 |

Seeks to notify the Central Goods and Services Tax (Third Amendment) Rules 2025.

|

|

14/2025-Central Tax |

17/09/2025 |

Seeks to notify category of persons under section 54(6).

|

|

15/2025-Central Tax |

17/09/2025 |

Seeks to exempt taxpayer with annual turnover less than Rs 2 Crore from filing annual return.

|

|

16/2025-Central Tax |

17/09/2025 |

Seeks to notify clauses (ii), (iii) of section 121, section 122 to section 124 and section 126 to 134 of Finance Act, 2025 to come into force.

|

Click to view / Download

Date : 17/09/2025

CGST (Rate) Notification , Dated 17th September 2025

|

Notification No. |

Date |

Subject |

|

09/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to supersede Notification No. 1/2017- Central Tax (Rate) dated 28.06.2017.

|

|

10/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to supersede Notification No. 2/2017- Central Tax (Rate) dated 28.06.2017

|

|

11/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No. 3/2017- Central Tax (Rate) dated 28.06.2017.

|

|

12/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No. 8/2018- Central Tax (Rate) dated 25.01.2018.

|

|

13/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No. 21/2018- Central Tax (Rate) dated 26.07.2018.

|

|

14/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to notify GST rate for bricks

|

|

15/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No 11/2017 - Central Tax (Rate) dated 28th June, 2017 to implement the recommendations of the 56th GST Council.

|

|

16/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No 12/2017-Central Tax (Rate dated 28th June, 2017 to implement the recommendations of the 56th GST Council.

|

|

17/2025-Central Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No. 3/2017- Central Tax (Rate) dated 28.06.2017.

|

Click to view / Download

Date : 17/09/2025

IGST (Rate) Notification , Dated 17th September 2025

|

Notification No. |

Date |

Subject |

|

09/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to supersede Notification No. 1/2017- -Integrated Tax (Rate) dated 28.06.2017.

|

|

10/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to supersede Notification No. 2/2017- -Integrated Tax (Rate) dated 28.06.2017

|

|

11/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No. 3/2017- -Integrated Tax (Rate) dated 28.06.2017.

|

|

12/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No. 9/2018- -Integrated Tax (Rate) dated 25.01.2018

|

|

13/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No. 22/2018- -Integrated Tax (Rate) dated 26.07.2018.

|

|

14/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to notify GST rate for bricks

|

|

15/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No 8/2017- Integrated Tax (Rate), dated 28th June, 2017 to implement the recommendations of the 56th GST Council.

|

|

16/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No 9/2017-Integrated Tax (Rate), dated 28th June, 2017 to implement the recommendations of the 56th GST Council.

|

|

17/2025-Integrated Tax(Rate) |

17/09/2025 |

Seeks to amend Notification No 14/2017-Integrated Tax (Rate), dated 28th June, 2017 to implement the recommendations of the 56th GST Council.

|

Click to view / Download

Date : 17/09/2025

Clarification on treatment of secondary or post-sale discounts under GST

Circular 251/08/2025-GST clarifies tax treatment under GST of secondary or post-sale discounts offered by manufacturers to dealers/distributors.

The clarification is in respect of ITC on Financial/Commercial Credit Notes, Post-Sale Discounts as Consideration for Dealer’s Supply to End Customer, Post-Sale Discounts as Consideration for Promotional Services.

1. ITC on Financial/Commercial Credit Notes

Recipient can avail full ITC even if supplier issues financial/commercial credit notes and recipient makes discounted payments.

Recipient can avail full ITC even if supplier issues financial/commercial credit notes and recipient makes discounted payments.

Since such credit notes do not reduce supplier’s tax liability (as clarified earlier in Circular No. 92/11/2019-GST dated 07.03.2019), the transaction value and tax charged remain unchanged.

Hence, recipient need not reverse ITC attributable to the discount

Since such credit notes do not reduce supplier’s tax liability (as clarified earlier in Circular No. 92/11/2019-GST dated 07.03.2019), the transaction value and tax charged remain unchanged.

Hence, recipient need not reverse ITC attributable to the discount

|

|

2. Post-Sale Discounts as Consideration for Dealer’s Supply to End Customer

When dealer sells goods to end customer independently (principal-to-principal), post-sale discounts from manufacturer are merely price reductions, not consideration for further supply.

However, if the manufacturer has an agreement with end customer to supply goods at a discounted price, and issues credit notes to dealer to enable such supply, then the discount is an inducement and forms part of consideration.

3. Post-Sale Discounts as Consideration for Promotional Services

Generally, discounts given to dealers cannot be treated as consideration for promotional activities, since dealers promote goods they own to increase their own sales.

GST is not applicable unless there is a specific agreement where dealer provides identifiable services (advertising, co-branding, special drives, exhibitions, customization, customer support, etc.) against defined consideration.

In such cases, it amounts to a separate supply of service, taxable under GST.

Click to view /download Circular 251/08/2025-GST

Date : 16/09/2025

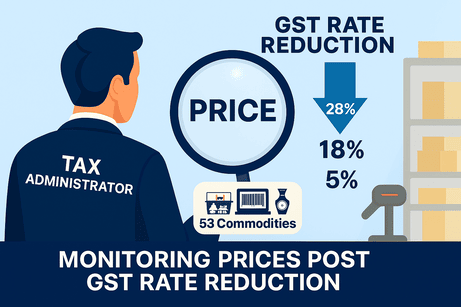

Monitoring of Price Data pre and post GST rate rationalization w.e.f. 22/09/2025

|

Ministry of Finance has vide communication Reference F. No. -190349/43/2025-TRU dated 09/09/2025 issued a directive to all Principal Chief Commissioners and Chief Commissioners of CGST zones regarding the monitoring of Maximum Retail Price (MRP) changes following the GST rate reduction effective from September 22, 2025.

Monitoring is required in respect of the 53 commodities for period till March 2026. First monthly report to be furnished by 30th September 2025.

Monitoring is required in respect of the 53 commodities for period till March 2026. First monthly report to be furnished by 30th September 2025.

The commodities covered are

The commodities covered are

|

|

|

Food & beverages |

Condensed milk, cheese, ghee, UHT milk, dry fruits, chocolates, biscuits, cornflakes, ketchup, jams, ice cream, cereals, drinking water bottles, soya milk drinks. |

|

Personal care & hygiene |

Soaps, shampoos, hair gel, toothbrush, toothpaste, shaving items, face powder, sanitary wipes, diapers. |

|

Medical & healthcare |

Medicines, diagnostic kits, thermometers, glucometers, gauze/bandages, contact/spectacle lenses. |

|

Stationery & education items |

Exercise books, pencils, crayons, sharpeners, erasers, geometry boxes. |

|

Household & utilities |

Dishwashers, kitchen utensils (wood, steel, copper, porcelain), cement, umbrellas, solar cookers, solar water heaters. |

|

Durables & others |

Televisions, monitors, projectors, bicycles, toys. |

Click to view / Download

Date : 16/09/2025

Permission to declare revised MRP, pursuant to GST Rate revision, on unsold stock

The Department of Consumer Affairs has vide Circular Reference F. No. I-10/14/2020-W&M dated 09.09.2025 permitted display of revised MRP on unsold stock as on the date of revision of GST Rates pursuant to the decision in the 56th GST Council Meeting held on 03/09/2025.

The brief details are

Manufacturers or packers or importers of pre-packaged commodities may declare the revised retail sale price (MRP) on the unsold stock manufactured/ packed/ imported prior to revision in GST after inclusion of the applicable/ increased or reduced amount of tax due to change in GST, in addition to the existing retail sale price (MRP), upto 31/12/2025 or till such date the stock is exhausted, whichever is earlier.

Manufacturers or packers or importers of pre-packaged commodities may declare the revised retail sale price (MRP) on the unsold stock manufactured/ packed/ imported prior to revision in GST after inclusion of the applicable/ increased or reduced amount of tax due to change in GST, in addition to the existing retail sale price (MRP), upto 31/12/2025 or till such date the stock is exhausted, whichever is earlier.

Such Declaration of the changed retail sale price (MRP) shall be made by way of stamping or putting sticker or online printing, as the case may be, after complying with the following conditions

Such Declaration of the changed retail sale price (MRP) shall be made by way of stamping or putting sticker or online printing, as the case may be, after complying with the following conditions

The change in price must be shown through stamping, stickers, or online printing, without overwriting the original MRP.

The change in price must be shown through stamping, stickers, or online printing, without overwriting the original MRP.

|

|

The original MRP shall continue to be displayed and the revised price shall not overwrite on it.

The difference between the retail sale price originally printed on the package and the revised pride shall not, in any case, be higher than the extent of increase in the tax if any, or in the case of imposition of fresh tax, such fresh tax, on account of implementation of GST Act and Rules. In the case of reduction in tax, the revised price shall not, in any case, be higher than the extent of price after reduction of tax.

Two newspaper advertisements should be released ,dealers notified by circular and the Director of Legal Metrology (Central), and State Controllers about the revised prices.

Use of unexhausted packaging material/wrapper has also been allowed, after making the necessary corrections by way of stamping or putting sticker or online printing, upto 31/12/2025 or till such date the packing material is exhausted, whichever is earlier.

Click to download Circular reference F. No. I-10/14/2020-W&M dated 09.09.2025

GSTN Advisory to file pending returns before expiry of three years

As per the Finance Act, 2023, effective 1st October 2025, taxpayers will not be able to file pending GST returns that are older than three years from their original due date.

This restriction applies to all major returns such as GSTR-1, 3B, 4, 5, 6, 7, 8, and 9/9C.

For example, returns like GSTR-1 and 3B of August 2022, GSTR-4 of FY 2021-22, and GSTR-9/9C of FY 2020-21 will be barred from filing from October 2025 onwards.

Click to view / Download

Date : 09/09/2025

GST 2.0 unveiled

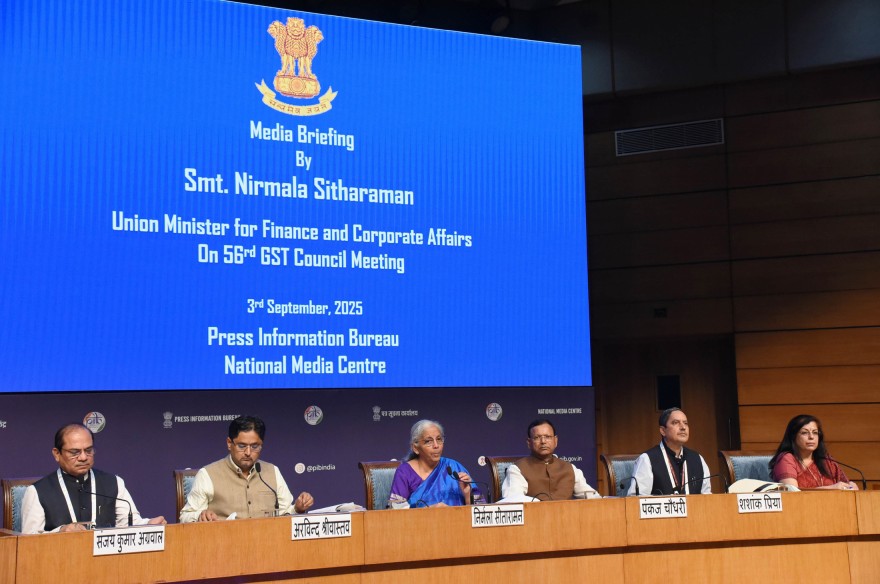

Recommendations of the GST Council Meeting held on 03/09/2025

The 56th GST Council Meeting held at New Delhi on 03/09/2025, chaired by the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman approved implementation of the following re-structuring of GST Rates to simplify and modernize the tax system.

The 56th GST Council Meeting held at New Delhi on 03/09/2025, chaired by the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman approved implementation of the following re-structuring of GST Rates to simplify and modernize the tax system.

GST Rate Rationalisation ionalisation ionalisation ionalisation ionalisation ionalisation ionalisation

GST will hereafter have only two core rates, namely 5% and 18%, thereby eliminating the older 12% and 28% slabs.

GST will hereafter have only two core rates, namely 5% and 18%, thereby eliminating the older 12% and 28% slabs.

40% rate introduced for sin and luxury items like tobacco, pan masala, luxury SUVs, and sugary drinks and in Services, Betting, gambling, horse racing, lottery, casinos, and online money gaming.

40% rate introduced for sin and luxury items like tobacco, pan masala, luxury SUVs, and sugary drinks and in Services, Betting, gambling, horse racing, lottery, casinos, and online money gaming.

|

|

Timeline for implementing revised GST Rate of Tax

The Council decided that the changes in GST rates may be implemented in a phased manner as follows

The changes in GST rates on services will be implemented with effect from 22nd September 2025

The changes in GST rates of all goods except pan masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and bidi, will be implementedwith effect from 22nd September 2025.

Pan Masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and bidi will continue at the existing rates of GST and compensation cess where applicable, till loan and interest payment obligations under the compensation cess account are completely discharged.

Simplification of Compliance and Procedures

The GST Council has also approved the following compliance modifications to streamline procedures, reduce litigation, and enhance ease of doing business under GST.

The Council approved risk-based provisional refunds for zero-rated supplies, allowing 90% refund upfront, effective from 1-11-2025.

Similar provisional refund mechanism was extended to inverted duty structure cases, pending CGST Act amendment.

Refund threshold for low-value export consignments will be removed, benefiting small exporters using courier/postal modes.

A simplified GST registration scheme for small, low-risk businesses will enable automated registration within 3 days.

A simplified GST registration scheme for small, low-risk businesses will enable automated registration within 3 days.

A new registration mechanism for small e-commerce suppliers across states was approved in principle to ease compliance

A new registration mechanism for small e-commerce suppliers across states was approved in principle to ease compliance

The place of supply for intermediary services will now be based on the recipient’s location, aiding Indian service exporters

The place of supply for intermediary services will now be based on the recipient’s location, aiding Indian service exporters

Retail sale price-based valuation will now apply to tobacco and pan masala products, replacing transaction value.

Retail sale price-based valuation will now apply to tobacco and pan masala products, replacing transaction value.

Post-sale discount provisions were simplified by removing pre-agreement requirements and enabling credit note-based adjustments.

Post-sale discount provisions were simplified by removing pre-agreement requirements and enabling credit note-based adjustments.

AI-powered invoice matching, auto-filled returns, and faster export refunds

AI-powered invoice matching, auto-filled returns, and faster export refunds

Uniform tax rules rolled out for sectors like e-commerce, drones, online gaming, medical devices, and insurance

Uniform tax rules rolled out for sectors like e-commerce, drones, online gaming, medical devices, and insurance

Inverted duty issues fixed in textiles, footwear, and fertilizers

Inverted duty issues fixed in textiles, footwear, and fertilizers

Operationalization of the Goods and Services Tax Appellate Tribunal (GSTAT)

The Tribunal will begin accepting appeals by the end of September 2025 and commence hearings by December 2025.

The Tribunal will begin accepting appeals by the end of September 2025 and commence hearings by December 2025.

The Council has set a deadline of 30-6-2026 for filing pending cases, to address the backlog of appeals.

The Council has set a deadline of 30-6-2026 for filing pending cases, to address the backlog of appeals.

The Principal Bench of the GSTAT will also serve as the National Appellate Authority for Advance Ruling,

The Principal Bench of the GSTAT will also serve as the National Appellate Authority for Advance Ruling,

Click to view / Download

GST Council Meeting 03-09-2025 - Press Release

GST Council Meeting 03-09-2025 -FAQs

GST Council Meeting 03-09-2025 - Rate Schedule changes

Image Source: PIB

Date : 03/09/2025

GSTN Advisory on System Enhancement for Order-Based Refunds

Refunds could be claimed only if:

i. Cumulative Demand ID balance was negative.

ii. Status of Demand ID was “Refund Due”.

iii. Issue: Taxpayers could not claim refunds where minor heads showed negative balances but the overall balance was zero/positive

iv. Refunds can be claimed irrespective of Demand ID status

v. Refunds allowed even if cumulative balance is zero/positive, as long as a minor head shows negative balance.

vi. Only negative balances auto-populated in refund application (Form RFD-01).

vii. Order number suggestions: System suggests latest demand order linked to the negative balance (e.g., order-in-original, rectification, appellate order).

viii. Tooltips added: Guidance provided for entering Order No. and Demand ID.

Click to view / Download

Date : 28/08/2025

CGST Notification 12/2025 , Dated 20th August 2025 - GSTR-3B Due Date for July 2025 Extended to 27th August in Some Selected Districts

The due date for filing GSTR-3B for July 2025 has been extended to 27th August 2025 for registered persons in Mumbai (City & Suburban), Thane, Raigad, and Palghar districts of Maharashtra, providing compliance relief under the CGST Act, 2017.

Click to view / Download

Date : 20/08/2025

|

|

|

|

| |

|

|

|

|

| | |