|

Annex 3: Direct Tax Turnover Approach to Estimating RNR

At the producer level, the GST base is equivalent to the value added which is the value that a

producer adds to his raw materials or purchases before selling the new or improved product or

service. That is, the inputs (the raw materials, transport, rent, advertising, and so on) are bought,

people are paid wages to work on these inputs and, when the final good or service is sold, some

profit is left. So value added can be looked at from the additive side (wages plus profits) or from

the subtractive side (output minus inputs).

2. Value added = wages + profits = output – input. If the tax rate on this value added is‘t’,

there are four basic forms that can produce an identical result:

1) t (wages + profits) : the additive – direct (accounts) method;

2) t (wages) + t (profits): the additive – indirect method40,

3) t (output – input) : the subtractive – direct (accounts) method; and

4) t (output) – t (input) : the subtractive – indirect (the invoice or credit) method.

3. While there are four possible ways of levying a VAT, in practice, the method used

(number 4) never actually calculates the value added; instead, the tax rate is applied to a

component of value added (output and inputs) and the resultant tax liabilities are subtracted to

get the final net tax payable. This is sometimes called the “indirect” way to assess the tax on

value added. Since in actual practice, input tax credit will be allowed only on the basis of

invoice, we use the subtractive – indirect method for calculating the GST base and the

consequential, revenue neutral rate (RNR). The present exercise is an attempt to calculate the

single RNR using this method. Mathematically,-

Total Revenues (R) = t* (output) – t*(inputs)

= t* (output – inputs)

= t* (Base)

or, Single RNR, ‘t’ = R / Base

4. For the purpose of estimating the RNR, we use the extensive producer level data in the

form of profit and loss accounts available with the Income Tax Department. These accounts

relate to 94, 31, 508 business entities for the financial year ending on 31st March, 2013

(financial year 2013-14)41. These entities comprise of all companies, partnership firms and

proprietorships but do not include charitable organizations. The activities of these entities are

classified into 10 sectors and further sub classified into 75 sub-sectors. We assume that these 94,

31, 508 entities constitute the universe of the GST taxpayers. This sample does not include

taxpayers who have filed their tax returns in paper form42 or engaged in charitable activities or

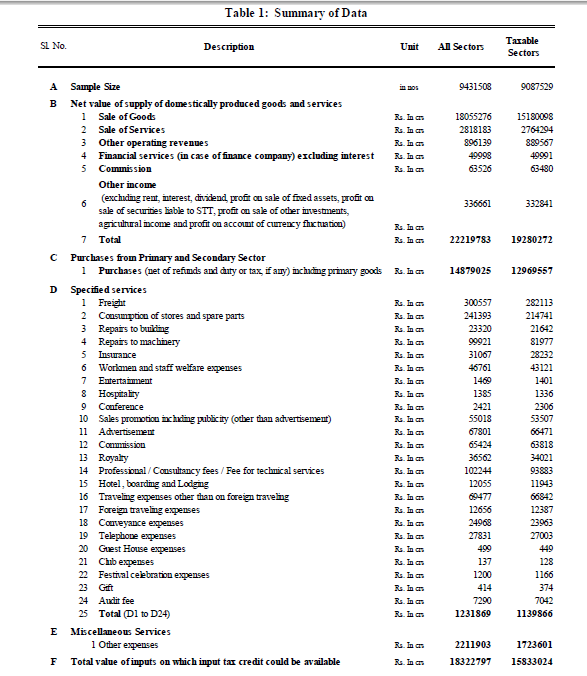

wholly engaged in agriculture. The summary of the data is presented in Table 1.

5. The computation of the GST base under the SI method involves the following steps:

a. The receipt items on the credit side of the Profit and Loss Account, which would be

liable to output tax, are identified and appropriately adjusted for indirect taxes to arrive

at the ‘value of supply of domestically produced goods and services (net of indirect

taxes)’ (hereinafter referred to as ‘net value of supply of domestically produced

goods and services’);

b. Since imports are liable to GST at the point of importation, the

‘value of imports’ is

aggregated with the ‘net value of supply of domestically produced goods and

services’ to arrive at the ‘net value of domestically available goods and services’.

c. Since exports are zero rated in a GST regime, the value of exports is reduced from the

‘net value of domestically available goods and services’ to arrive at the

‘net value of

goods and services available for domestic consumption’ or the ‘aggregate output

tax base’.

d. Similarly, the expense items on the debit side of the Profit and Loss Account, in respect

of which input tax credit would be potentially available, are identified and appropriately

adjusted for indirect taxes to arrive at the ‘value of purchase of intermediate goods

and services’.

e. Under the GST Model, full and immediate input credit is proposed to be allowed for

GST paid on purchase of capital goods in the year of purchase. Therefore, the ‘value of purchase of capital goods’ is aggregated with the

‘value of purchase of intermediate

goods and services’ to arrive at ‘gross value of purchase of intermediate goods and

services’.

f. Since no input tax credit would be available in respect of purchases made from

unregistered dealers, the ‘value of purchases from the unregistered dealers’ is

reduced from the ‘gross value of purchase of intermediate goods and services’ to

arrive at the ‘aggregate input tax base’.

g. Under the proposed GST Model, several sectors will be exempt from the scope of GST;

these are petroleum, land component of real estate, the interest component in the

financial sector, electricity, gem and jewellery, education and health services, and

agricultural produce. Reflecting this, appropriate downward adjustments have been

made to both the output and input tax base.

h. The threshold limit is proposed to be increased to Rs 40 lakh for both goods and

services. Therefore, appropriate downward adjustment to the GST base is made to also

reflect this.

i. The ‘aggregate output tax base’ is reduced by the

‘aggregate input tax base’ to arrive

at the ‘GST Base’.

6. The

“net value of supply of domestically produced goods and services” is the

aggregate of the value of (i) sale of goods; (ii) sale of services; (iii) other operating expenses; (iv)

financial services (excluding interest) provided by financial companies; (v) Commission; and

(vi) other income. The item ‘other income’ as reported in the accounts excludes rent, interest,

dividend, profit on sale of fixed assets, profit on sale of securities liable to STT, profit on sale of

other investments, agricultural income and profit on account of currency fluctuation. In practice,

a large number of professional entities report their gross receipts under this item since they do

not view themselves as carrying on business or engaged in sales. Since all goods and services

(except a small negative list) are proposed to be included in the GST base, the value of supply of

goods and services must therefore, include the item ‘other income’. However, receipts by way of

rent, dividend, interest, profit on sale of fixed assets, profit on sale of investment liable to STT,

profit on other investment, profit on currency fluctuation and agricultural income have been

excluded from the value of the supply of goods and services because either they represent

accretion to savings or have been effectively netted out in the calculation of the input base

eligible for input tax credit.

7. The

“net value of supply of domestically produced goods and services” by all sectors

is estimated to be Rs. 222,19,873 crore in the financial year 2013-14. However, diamond

cutting, petroleum, rice and flour mill and power and energy sectors (hereafter collectively

referred to as “exempt sectors”) are proposed to be exempt from GST. After adjusting for the

“exempt sectors”, the “net value of supply of domestically produced goods and services” for

the taxable sectors is estimated to be Rs 192, 80,272 crore.

8. Input tax base comprises of all goods and services used as intermediate inputs in the

production of goods and services and on which output tax has been paid. The ‘value of

purchases of intermediate goods and services’ by all sectors is the aggregate of the

expenditure on items listed in Table-1. These purchases can be classified as purchases from the

primary sector, secondary sector and tertiary sector. The aggregate of purchases by all entities

from these three sectors is estimated to be Rs 183, 22,797 crore during the financial year 2013-

14. After adjusting for the exempt sectors, the aggregate of purchases by taxable sectors is

estimated to be Rs 158, 33,024 crore.

9. In the case of

purchases from the primary sector (i.e. primary goods) like cereals and

plantation crops, no input tax credit would be allowed since these goods would be exempt from GST. If for some reason, the agriculturist falls within the scope of the GST, he would be liable to

collect GST for which the purchaser in our sample would be eligible to claim input credit.

However, agriculturists do not ordinarily file an income tax return, and therefore, their sales do

not form part of the output base estimated above. In either case, purchases of primary goods in

this exercise would not be entitled to any input tax credit. The value of such purchases by the

taxable sectors is estimated to be Rs.11, 04,545 crore during the financial year 2013-14.

10. As regards

purchases from secondary sector is concerned, they are generally made

from both registered and unregistered dealers. To the extent these are acquired from registered

dealers, full input tax credit would be available. However, where purchases of trading goods and

raw materials are made from unregistered dealers, no input tax credit would be available since no

output tax would have been paid by the registered dealer purchaser. Since there is no bifurcation

of purchases from registered and unregistered dealers in the Profit and Loss Accounts, the

amount of purchases from unregistered dealer needs to be estimated. Based on anecdotal

information, it is estimated that 10 per cent of the purchases of trading goods and raw materials

from the secondary sector is acquired from unregistered dealers on which no input credit would

be available. The value of such purchases from unregistered dealers, by taxable sectors, is

estimated to be Rs 11, 86,501 cores during the financial year 2013-14.

11. Similarly, value of

specific services and miscellaneous services purchased by taxable

sectors, from unregistered dealers, are estimated to be 25 per cent and 40 per cent, respectively.

This translates to Rs 4, 36,619 crore and Rs 6, 89,440 crore, for specific services and

miscellaneous services, respectively. The aggregate purchase of services from unregistered

dealers is determined at Rs 11, 26,059 crore.

12. Accordingly, the

‘value of purchases from unregistered dealers’ in 2013-14 for

taxable sectors is determined at Rs.23, 12,560 crore. Since no input tax credit would be allowed on these purchases, the same is deducted from the value of purchases of intermediate goods and

services for determining the GST base.

13 In the design of the GST, several

exemptions are envisaged. In particular, these relate to

primary goods including unprocessed food, health, education, petroleum, land component of real

estate, alcohol and power and energy. The impact of these exemptions has been factored in the

calculation of GST. In the case of some of these exemptions, the producers are not required to

file their income tax returns and, therefore, do not form part of the sample. Accordingly, while

no adjustment is required to be made to the output tax base, a downward adjustment has been

made to the input tax base. In all other cases, downward adjustment has been made to both the

output tax and input tax base.

14. In terms of the proposed GST Model, the tax base will include real estate to the extent

that the present scheme of taxation will continue. In the light of this, the value of rental services

has been excluded from both the output tax and the input tax base. However, in the case of land,

no information is separately available for the amount embedded in real estate services. Since the

value of land is included in both the output tax and input tax base, this amounts to a wash

transaction having no impact on the GST base.

15. Under the GST, a

threshold exemption is proposed to be provided for registration of

dealers. Since no decision has yet been taken on the level of the threshold exemption, we assume

that the same will be fixed at Rs 40 lakh. Table -2 shows the distribution of taxpayers across

turnover. As would be noted, there are 7442736 dealers with turnover below Rs 40 lakh

accounting for a total turnover of Rs 3,00,377 crore only. Effectively, 79 per cent of the total

dealers accounting for approximately 1.35 per cent of the total turnover base will remain outside

the GST net. Calculated on a pro-rata basis, the value addition by these dealers is estimated at Rs

63,109 crore and the GST base is reduced accordingly.

Table 2: Distribution across Turnover

| Turnover |

Corporate |

Non-Corporate |

Total |

| |

Number

of cases |

Total

Turnover

(in Rs. crs) |

Number

of cases |

Total

Turnover

(in Rs. crs) |

Number

of cases |

Total

Turnover

(in Rs. crs) |

| Less than 0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Between 0 and Rs 10 lakh |

356036 |

3186 |

6077867 |

81777 |

6433903 |

84964 |

| Between Rs 10 lakh and Rs 25 lakh |

35152 |

5898 |

647707 |

105854 |

682859 |

111751 |

| Between Rs 25 lakh and Rs 40 lakh |

21875 |

7010 |

304099 |

96652 |

325974 |

103662 |

| Between Rs 40 lakh and Rs 1 crore |

51385 |

34476 |

616905 |

412195 |

668290 |

446671 |

| Between Rs 1 crore and Rs 2 crore |

41455 |

59682 |

461638 |

653155 |

503093 |

712837 |

| Between Rs 2 crore and Rs 5 crore |

48910 |

158340 |

378129

|

182874 |

427039 |

1341213 |

| Between Rs 5 crore and Rs 10 crore |

31696 |

226691 |

155235 |

1081062 |

186931 |

1307752 |

| Between Rs 10 crore and Rs 100 crore |

60571 |

1891079 |

124932 |

2800947 |

185503 |

4692026 |

| Above Rs 100 crore |

14130 |

12579433 |

4186 |

1146675 |

18316 |

13726108 |

| Total |

661210 |

14965794 |

87706988 |

7561190 |

9431908 |

22526984 |

16. The comprehensive GST is intended to bring within its fold

rail transport services also.

The rail transportation sector is entirely under the Ministry of Railways which is not required to

file a tax return. Therefore, the sample does not include rail services. Accordingly, based on the

information contained in the National Accounts (2014), the GST Base in respect of rail services

is estimated at Rs 79,759 crore.

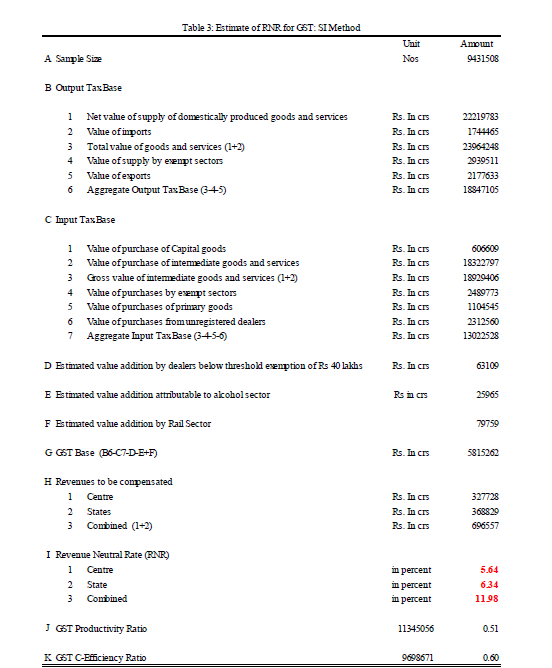

17. In the light of the aforesaid discussions, the step-wise calculation of the GST Base for

base year 2013-14 is presented in Table -3. As would be noted, the GST base is determined at

Rs 58, 15,262 crore. The implicit value addition is estimated to be 31 per cent of the total output

tax base. Consequently, the RNR for the Centre and the State is estimated to be 5.64 per

cent and 6.34 per cent, respectively. The combined RNR is determined at 11.98 per cent.

Table 3: Estimate of RNR for GST: SI Method

Notes:

1 This method is so called because value added itself is not calculated but only the tax liability on the components of

value added is calculated.

2 These accounts have been electronically filed with the Income Tax Department along with their return of income

for assessment year 2014-15. They relate to returns filed up to 30th June , 2015.

3 This does not affect the estimation results since these are very small taxpayers with low turnover; therefore, they

are likely to be below the threshold limit of Rs 40 lakh envisaged under the GST.

|