|

Communications and Manuals of the GST Portal (www.gst.gov.in) is presented

here.

Click on the relevant link to view.

Confusion on due date for filing of FORM

GST TRAN-1

In the absence of official Orders, the

due date for filing of FORM GST TRAN-1

appears to remain as 28th September,2017

and is not October 31,2017, as in the

press release of the decisions of the

GST Council.

Though the

GST Council had in the recent meeting

decided to extend the due date for

filing of declaration in FORM GST TRAN-1

to October 31,2017, in the absence of

official Orders extending the due date,

it appears that the due date for filing

of FORM GST TRAN-1 remains as 28th

September,2017.

Here is the basis for this concern

a) Rule 117 of CGST / SGST Rules specify

that transition credit shall be claimed

by filing FORM GST TRAN-1 within ninety

days of the appointed day. i.e before

28th September,2017. Rule 117 also

provides that the Commissioner may, on

the recommendations of the Council,

extend the period of ninety days by a

further period not exceeding ninety

days.

b) The press release issued after the

recent meeting of the GST Council on

September 9,2017 stated as follows:

a) Form GSTR 1 can be revised once.

b) The due date for submission of Form

GST TRAN-1 has been extended by one

month i.e 31st October,2017

c) The Government had issued

Notification No. 34/2017 – Central Tax

dated 15th September, 2017 to give

effect to the decisions of the GST

Council. In this Notification Rule 120A

reading as follows was inserted enabling

the Commissioner to issue orders for

revision of the declaration filed in

FORM GST TRAN-1

“120A.

Every registered person who has

submitted a declaration electronically

in FORM GST TRAN-1 within the time

period specified in rule 117, rule 118,

rule 119 and rule 120 may revise such

declaration once and submit the revised

declaration in FORM GST TRAN-1

electronically on the common portal

within the time period specified in the

said rules or such further period as may

be extended by the Commissioner in this

behalf.”

d) The CGST Commissioner has in exercise

of the powers under Rule 120A issued the

attached Order No. 02/2017-GST extended

the time limit for submitting the

declaration in FORM GST TRAN-1 only

under rule 120A of the Central Goods and

Service Tax Rules, 2017

Since the order is issued under Rule

120A and not under rule 117, rule 118,

rule 119 and rule 120 which relates to

filing of FORM GST TRAN-1, there is

confusion on implementation of the

decision of the GST Council to extend

the due date of filing of FORM GST

TRAN-1.

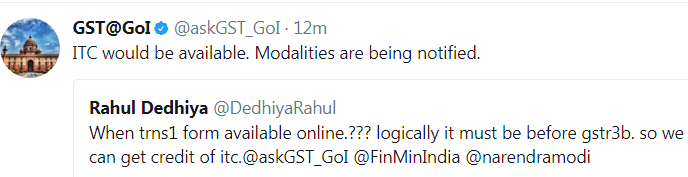

The following tweet confirms this

In the circumstances, it appears

necessary to file FORM GST TRAN-1

positively by 28th September, 2017.

While the endeavor should be to file

complete details in FORM GST TRAN-1, the

form should be filed with whatever

details is possible so that the option

to file revised declaration by 31st

October 2017 is available.

Since the decision of the GST Council to

extend the due date to file FORM GST

TRAN-1 to 31st October,2017 is

sacrosanct and is to be implemented, it

is likely that another order may be

issued. We shall update if and when an

order is issued.

Click to view / download CGST Order

under Rule 120A of CGST Rules

Date : September 21, 2017

Filing of GSTR 3 B – Really taxing times

As we are all aware the due date for filing of the return in Form GSTR 3B for July 2017 is only 20th August, 2017 except for those opting to avail of transition credit by filing Form GSTR TRAN-1.

The due date of filing of return for those availing of transition credit is extended to 28th August, 2017 subject to filing of GSTR TRAN-1 before filing of GSTR 3B. However the tax payable net of transition credit is to be paid by 20th August, 2017.

It is expected that modified Form GSTR 3B with provision to report transition credit would be made available. It is possible that the transition credit availed in GSTR TRAN-1 may have to be filled in or would get auto populated in Form GSTR 3B based on GSTR TRAN-1 filed.

We understand that once submitted Form GSTR 3B cannot be amended or edited. Therefore, please take care to validate data before submitting the return.

For those who could have made mistakes, here is the tweet that “errors and omissions can be shown in the next month’s return”

Clarifications required on GSTR TRAN-1

It is not clear at this point of time if filing of Form GSTR TRAN-1 would be available more than once. i.e. whether Cenvat Credit carried forward can only be availed now and VAT Credit carried forward may be availed later and whether other tables like details of statutory forms received for which credit is being carried forward and Details of goods sent to job-worker and held in his stock on behalf of principal under section 141 and details required in other tables of GSTR TRAN-1 are to be filed now.

The concern is whether all applicable tables in Form GSTR TRAN-1 is required to be filled in at one go before filing GSTR 3B. This is required to be clarified by the authorities urgently.

For those opting to file Form GSTR

TRAN-1 is advisable that details of all tables in GSTR TRAN-1

be kept ready before opting to avail of transition credit.

Click on the links hereunder to view /download the documents relevant to filing of Form GSTR 3B

Tutorial of GSTN on filing of Form GSTR 3B,

FAQs on filing of Form GSTR 3B, of GSTN

Filing of enrolment Form necessary to file GSTR 3B

Guidelines for filling in Form GSTR 3B and

brief note on the constituent of the definitions of different kinds of “Supply”

to be understood for correct reporting of the turnover of outward supplies and inward supplies, prepared by our team.

Date : August 18, 2017.

Due Date for filing of GST Return in Form GSTR-3B extended for those claiming transitional credit (Press Report)

The economic times has reported that the deadline for filing of GST Return, GSTR- 3B for July 2017, has been extended to August 28th from August 20th, 2017 only for taxpayers who file the return in form GSTR TRAN-1, to claim transitional credit. Form GSTR TRAN-1 is to be filed before filing of GSTR 3-B.

The due date for filing of GST Return GSTR- 3B for those not filing form GSTR TRAN-1 remains as 20th August, 2017.

Link to view the press release is

http://economictimes.indiatimes.com/articleshow/60104417.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Date : August 17, 2017.

Transition Credit in GSTR-3B

Since there is no separate field / column in GST Return Form GSTR-3B for claiming of transition credit, there had been doubts on whether transitional credit can be claimed and adjusted against the tax payable for July, 2017 and August, 2017.

It now learnt that modalities for claiming of transitional credit in Form GSTR -3B would be notified and that GST Form TRAN-1 and GST Form TRAN-2 would be enabled for filing by 21st or 22nd August.

It is likely that the tax payers would be required to pay the tax due net of transitional credit by 20th August, 2017 and the period for filing of Form GSTR -3B for those availing transition credit would be extended by a week.

We shall update soon after the official notification is published.

Date : August 12, 2017.

|